Serving you worldwide since 1995.

Semiconductor industry

Growth in the semiconductor industry

Increasing digitalization and technological developments such as autonomous driving, cloud computing, AI, and the Internet of Things are placing ever greater demands on microchips—very small electronic components with microelectronic semiconductor devices.

The performance of these semiconductor devices is increasing, while at the same time their structures are becoming smaller and more delicate.

Leading companies in the semiconductor industry include Intel, Samsung Electronics, Qualcomm, Broadcom, Nvidia, SK Hynix, AMD, Apple, STMicroelectronics, and Texas Instruments.

Intel and Samsung are among the so-called IDMs (Integrated Device Manufacturers). These companies cover the entire production process (from design and manufacturing to marketing), while so-called fabless companies focus on only one production step. These include, for example, Qualcomm, Broadcom, Nvidia, and AMD, which specialize in development (design).

The designed chips are then produced in foundries (contract manufacturers) using highly complex processes. The Taiwanese company TSMC is one of the largest contract manufacturers alongside Samsung and GlobalFoundries.

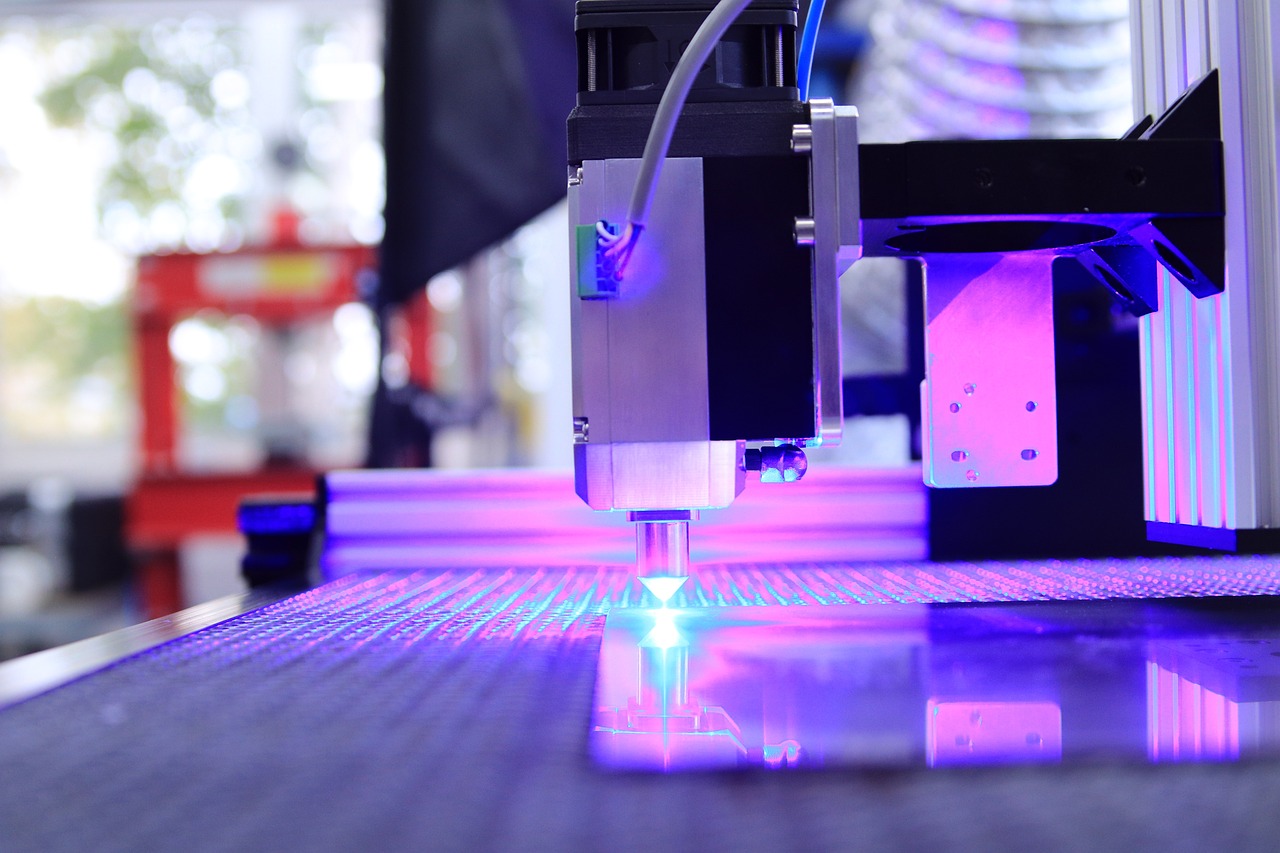

Special equipment is required to produce these state-of-the-art chips. The Dutch chip manufacturing company ASML occupies a special position in this field. To date, chips with a structure size of ≤ seven nanometers can only be manufactured using EUV (extreme ultraviolet light) equipment from ASML.

The production steps of assembly, testing, and packaging take place in so-called OSAT (outsourced semiconductor assembly and test) companies. Leading service providers in this field include Amkor Technology (USA) and ASE Technology (Taiwan). Due to lower labor costs, these back-end plants are often located in Asia.

The semiconductor market is experiencing significant growth and is being promoted with high levels of investment. In 2023, global sales in the semiconductor industry amounted to $526.8 billion. Global sales are forecast to reach $687.38 billion in 2025.

In order to become less dependent on supplies from Asia, the European Commission's “Chips Act” aims to boost European semiconductor production. More than €43 billion is to be invested in the chip industry by 2030, doubling Europe's share of global chip production from 10 percent today to 20 percent.

The reduction in the structural size of semiconductor components goes hand in hand with ever-increasing demands for the cleaning of the smallest particles. With our mega-sound systems, particle sizes down to 2 nanometers can be gently cleaned.

Source: Statista; Stand 12.04.2024

MEMS microsystem/ligation technology

Megasonics in microsystem technology MEMS / LIGA technology

LIGA technology consists of three processes: lithography, electroplating, and molding. This process is used in particular when structures with high aspect ratios are required.

SONOSYS® megasonic systems improve LIGA processes.

In the development process of microstructures with high aspect ratios, the use of megasonic and the microflow that occurs as a result completely flushes out the particles and reduces development times by a factor of 7.

For fragile structures, the depth of the structures can be increased by a factor of 2.

Source: El-Kholi, Straka (1998), FZK_LIGA_Report, S. 1

Optical industry

The secret champion of the German economy

The optical industry has its origins in Germany. One of the best-known pioneers in this sector is Carl Zeiss (1816-1888).

Although the German precision engineering and optical industry generated sales of €74 billion in 2019, it is one of the unsung heroes of the German economy.

The optical industry is involved in the manufacture of precision optical products. These include lasers for industrial and medical technology, measuring systems, microscopes, sensors, fiber optic products and LED lights.

Cleanliness and precision are of crucial importance here.

Our systems in the 400kHz and 600kHz frequency range are particularly suitable for cleaning polishing paste and/or larger particles, for example.

Immersion transducers, transducer plates, and nozzle systems are used for this purpose.

Source: Bundesministerium für Wirtschaft und Klimaschutz, Wirtschaftsbranchen Feinmechanik und Optik

Other markets

Sonochemistry

Sonochemistry refers to the application of ultrasound to chemical reactions and processes. Our wide frequency spectrum from 400kHz to 9MHz offers a wide range of applications, such as in the production of emulsions, degassing processes and the acceleration of chemical and electrochemical reactions.

Food industry

Every day, new and fascinating applications for megasonic applications are being discovered in the food industry. For example, natural flavorings can be extracted more effectively, food can be preserved longer without the addition of chemicals, the yield from the extraction of vegetable oils can be increased and the use of frying oils can be reduced. In addition to gentle and safe application, considerable costs can be saved in the process chain.

Our special submersible transducers have been used very successfully in palm oil extraction for over a decade. Our systems have also been used in olive oil extraction for many years. SONOSYS® is constantly opening up new fields of application in the food industry with its Australian research partner CSIRO.

Research institutions

SONOSYS® megasonic systems are becoming increasingly popular in various fields and research facilities. Whether in cancer research, agricultural research, materials research, medical technology, or histology—to name a few—our customized systems are popular thanks to their flexible performance range. Of particular interest for laboratory applications is the possibility of cost-effectively retrofitting process tanks with our megasonic systems.